Exploring Emergency Savings As An Employee Benefit

Due to confidentiality agreements, I can not show real deliverables that were used at Vanguard. All deliverables shown are examples used to demonstrate the type of work and processes performed.

Exploring Emergency Savings As An Employee Benefit

Project Introduction:

When congress passed the Secure Act 2.0 in 2023, it introduced Pension Linked Emergency Savings Accounts or “PLESAs” that are designed to function similarly to a 401(k) plan, but for emergency savings. These aim to incentivize participants to save for emergencies by leveraging employer match, high investment yields, and automatic payroll deduction.

Vanguard began exploring offering PLESA programs in 2024. To support this initiative, I was brought on as a Senior UX Researcher to gather feedback on how this program would be received by a wide range of end users.

Business Case: PLESA incentivizes 401(k) participants to keep more of their money at Vanguard. Customers who have more than one account at Vanguard have a higher likelihood of keeping their funds with the company even after they change jobs.

Research Overview:

Objective:

To deliver quotes, trends and insights to business partners that will convey the potential impact of PLESAs and support in strategic decision making on whether/how to implement the proposed program.

Methodology:

1:1 interviews over teams

Supplemental Survey

Tools:

Figma/FigJam

Qualtrics

Participants:

Interviews: 6 of each from the following groups

HR professionals - Potential administrators of the program

401(k) plan participants - Potential users or recipients of the program

Financial advisors - Potential advocates of the progr

Survey: n=535 401(k) participants

Timeline:

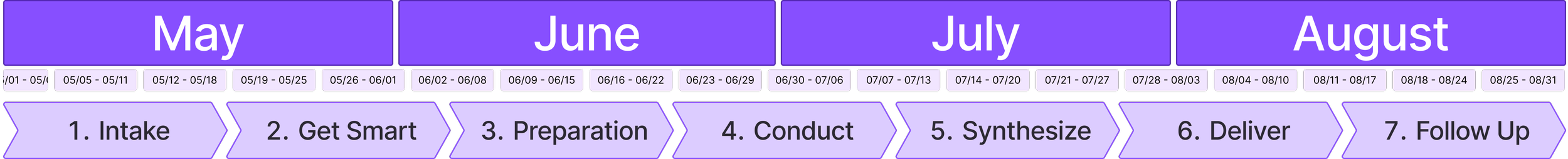

This study took place over 4 months. This is fairly long compared to my usual turn around time of about 1.5 months. In this situation, the study was unexpected, so the 4 months includes intake, concluding the prior study and a longer than usual get smart phase.

This study covered 3 interview rounds and a supplemental survey, each requiring it’s own recruitment, script, and synthesis, which also extended the timeline.

A broad stokes timeline is shown below, which also captures my typical 7 phase approach to planning, conducting, and delivering a study.

Phase 1: Intake

Background/Context:

In early 2024, I was assigned to the “Financial Wellness Journey” within Vanguard’s Workplace Solutions Department. We were responsible for anything related to financial education within the 401(k) space. We worked closely with the team that owned Vanguard’s high yield savings account product, “Cash Plus,” because it was seen as the primary vehicle for emergency savings (a key component of financial wellbeing.)

Research Request:

In early May, the product owner for Cash Plus, who was familiar with my work from the Financial Wellness Journey, reached out to request a UX research study to explore the viability of the PLESA program.

At the time, I was in the middle of a usability test and had another study scheduled to begin in June. I brought this request to the financial wellness team, as well as my manager, who all gave the green light to deprioritize the upcoming study and focus on this, as it had a larger potential impact and could be seen as a dependency to move forward with the rest of the PLESA exploration.

To go through proper channels, we had the Cash Plus product owner fill out our Research Intake Request Form. An example of this is shown below.

Phase 2: Get Smart

SME Interviews:

Once the project was approved, my first step was to schedule 1:1 meetings with relevant subject matter experts from within Vanguard.

For example, I met with the team responsible for all things Secure Act 2.0, who shared that clients have been showing interest in the PLESA provision and asking about it during meetings.

Secondary Research/Competitive Analysis:

A lot of behavioral research has been done on the concept of emergency savings as a whole. A paper published by the National Bureau Of Economic Research was instrumental in influencing the inclusion of the PLESA provision in Secure Act 2.0.

One notable study demonstrated the potential impact of emergency savings accounts on low income groups. It observed that workers who are paid into multiple accounts (rather than one account) are more likely to withdraw less during an emergency, and therefore save more in the long run.

Competitors like Fidelity were frontrunners in the PLESA space. They got a lot of positive publicity around a program they piloted with Delta Airlines in which participants could receive up to $1,000 in employer contributions to an emergency savings account if the employee met certain criteria. This led the way in Vanguard’s understanding of what successful PLESA programs could look like.

Research Plan:

Once I felt confident in my understanding of the problem space surrounding PLESA, I began developing the research plan. I scheduled a small meeting for those closest to the project (the Financial Wellness product owner and the owner of the Cash Plus product.) I walked them through a template I created to flesh out the research plan:

Most importantly, we identified the following three research objectives

To gather first impressions from participants around the PLESA program.

To identify concerns that would need to be addressed.

To target specific questions like - “What is the optimal recommended employer contribution to incentivize participation?”

Other important topics we covered that will be explained in detail later include:

Hypotheses and assumptions

Target participants and recruitment capabilities

Timeline and expected deliverables

Methodology and testing materials

Below is an recreation of what the research plan looked like (FigJam)

Phase 3: Prep

Stakeholder Engagement:

Since this project covered such a wide range of users and business lines, there were a lot of stakeholders to get buy in from. For anyone who wasn’t involved in the research planning phase, I scheduled a separate, one-on-one meeting with them to discuss their personal curiosities. I find this extremely important for achieving the following goals:

Get the stakeholder personally invested in the results of the study.

Gain valuable knowledge they might have about the project.

Get their support when dealing with roadblocks in the future (i.e., recruitment issues.)

In this stage, I might ask a stakeholder questions like:

If you could ask our users any question, what question would it be?

How do you think users will answer when we ask them that question?

What type of information would help you perform your job if you had it?

Examples of stakeholders I met with include:

Tech teammates aligned to the Financial Wellness section of the participant site.

Relationship Managers responsible for communicating with HR professionals.

Business leaders who control the budget needed to pursue a program like this.

Participant Recruitment:

Since this study covered three different user groups, each group was recruited differently.

HR Professionals: I leveraged the “Vanguard Research Community” in which plan sponsors agree in advance to be called upon to deliver feedback about new products. Although the community exists, it is still extremely hard to recruit from because these users are so busy and we can’t legally financially incentivize them. Basically, we send out the recruitment email and whoever agrees to meet, that’s who we interview. Luckily, we hit 6 which is was goal number.

401(k) Plan Participants: Contrary to the HR professionals, Vanguard’s community of employee participants numbers in the thousands and we are able to financially incentivize them. So when we sent out the recruitment email, hundreds of people responded. I was able to create an ideal sample in which demographics like age, income, race, and gender were all effectively balanced.

Consultants: Even worse than HR professionals, Consultant essentially will never answer a generic recruitment email. For this population, we had to do grass roots recruitment. Our strategy was to go to Vanguard crew members who interface with consultants regularly. I instructed them to broach the topic in an upcoming meeting and then CC me on a follow up email. From there, I was able to schedule the interview.

The interviews were scheduled across about a month and a half. Each group took about a week to conduct with a week in between to prep for the upcoming sessions. We conducted them in the order of recruitment ease (Participants > HR Professionals > Consultants) to allow for hiccups when recruiting from more difficult populations.

Script Development

Once the recruitment strategy was ready and moving forward, I was ready to begin on the scripts. Each group needed their own script, but they followed a similar formula.

Questions like “what are your initial impressions of emergency savings as an employee benefit” could be asked of all three groups and the participants will almost certainly answer from the perspective of the role they are filling at the moment. (I.e., an HR professional will rarely answer that question from perspective of a 401k participant themself.)

Part of my philosophy when doing open ended discovery like this is to lead the participant as little as possible. Because of that, my scripts are often very sparse (5-10 questions max.) Therefore, the primary interview skill becomes improvising and asking follow up questions in the moment based on the direction the participant decides to take.

Phase 4: Conduct

Watch Parties:

In this study (and for pretty much every study I do that involves interviews) I coordinate “Watch Parties.” A watch party is when I interview a participant in one teams meeting and stream that video to another teams meeting, in which anyone interested can attend.

The power behind the watch party is that the participant feels like it is an intimate conversation, while stakeholders are still able to listen in real time. This adheres to our consent form because participants are made aware that the sessions are being recorded and could be shared internally.

Additionally, since the stakeholders are all in another meeting, they are free to use the chat as much as they want to discuss what is happening during the interview. In this study, the chat would frequently be quite engaged, with stakeholders asking follow up questions or discussing interesting moments from the interview.

The top example of this was when a participant explained her experience struggling to save for emergencies. She keeps her emergency funds in a savings account at her bank and believes that the level of accessibility is actually a problem for her. She felt confident that hosting her emergency account at Vanguard could really help her practice the financial discipline she often struggles with. This story was very touching to the team.

Sharing Findings:

Although these findings were intended to roll up into a final report, the breadth of this study meant that it would be a long time between the first interview and the research readout. Due to this, we established a cadence of sharing “initial findings” directly after each round of interviews. This was usually in the form of a teams chat and was very informal. I would note down the most impactful takeaways so stakeholders could review and discuss if needed.

Phase 5: Synthesize

Note Taking:

I use a FigJam based note taking method that ends up looking something like what is shown below. When you select a sticky and click “Command + Return,” it starts a new sticky directly to the right. This allows me to take notes quickly in which each sticky is a separate thought.

In this study, I have 3 groups of 6. At that scale, I used color to differentiate user group. In the example below, color represents role - green is for sales people, blue is for receptionists, red is for managers. This allows for easily seeing grouping once affinitized.

I will also include a picture of the participant so I can easily recall them, as well as any pertinent information. For example, the size of their company or the consulting firm they work for.

Affinity Mapping:

Lorem ipsumes.

Phase 6: Deliver

Presentation Deck:

Lorem ipsum

Report Library Deck:

Lorem ipsumes.

One Pagers:

Lorem ipsumes.

Phase 7: Follow Up

Continued Partnership:

Lorem ipsum

Supplemental Survey

Lorem ipsumes.